Letterpress announced on April 28 that it will provide contract manufacturing and processing services for power semiconductors beginning in April 2023. The service commissions the transplantation of wafer manufacturing processes owned by equipment manufacturers and wafer manufacturers.

Under the partnership agreement with JS Foundry, the wafer manufacturing process will take place at the company's Niigata facility in Ochaya, Niigata Prefecture.

The service started out as a porting and manufacturing service for 6-inch wafers (approximately 150 mm in diameter), and also supported only certain processes related to wafer manufacturing, such as "epitaxial processes" and "backside processes."

By the end of fiscal 2024, the manufacturing scope will be expanded to include the 8-inch wafer (approximately 200 mm) process, and Toppan Technical Design Center, a semiconductor design subsidiary of letterpress printing, will assume the turnkey business of design-to-manufacture power semiconductors. We plan to start providing services.

The company is targeting sales of 3 billion yen in fiscal 2027, including related orders.

Japanese firms rushed to power semiconductors

Denso, the Japanese auto parts maker, said late last month that it would set up a major power chip production plant with UMC, a Taiwanese contract manufacturer, in a move that highlights growing demand for these specialised semiconductors, which are used in everything from electric cars to trains to wind turbines.

But the announcement is also another sign of what the Japanese government and industry experts say is the biggest weakness in the domestic chip industry: fragmentation.

Denso has chosen to partner with the local unit of a Taiwanese chipmaker, while four of its domestic peers are investing in their own production plants.

Power chips are semiconductors used to regulate electricity and are essential for everything from electric cars and air conditioners to data center servers and factory robots.

According to World Semiconductor Trade Statistics, the segment accounts for nearly 10 percent of the global $555 billion chip industry by 2021, and demand is expected to grow along with the broader semiconductor market. "They are indispensable devices for the global transition away from fossil fuels," said Hideki Wakabayashi, a professor at Tokyo University of Science and a member of the Ministry of Economy, Trade and Industry (METI) advisory panel.

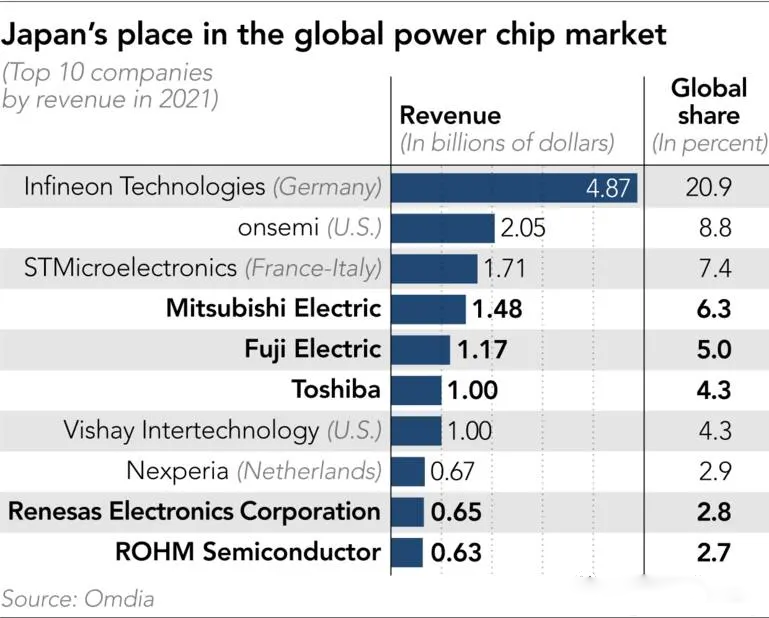

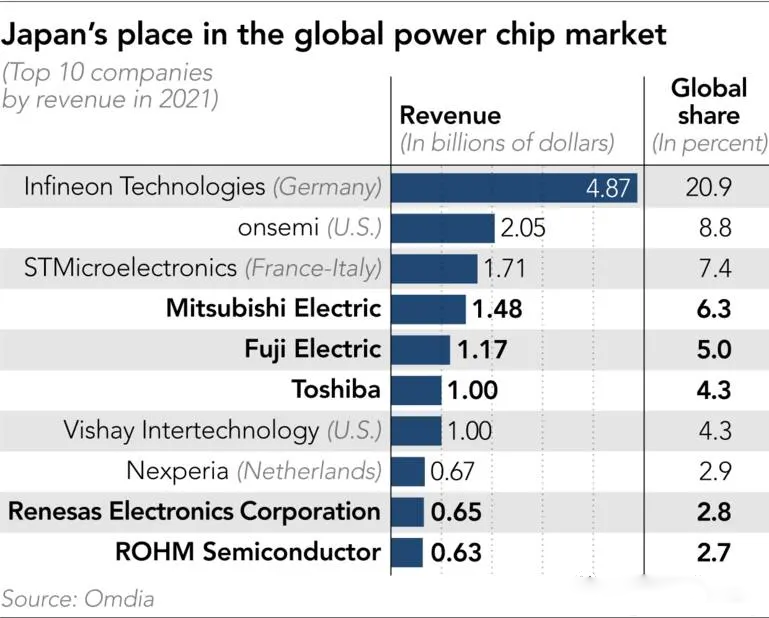

The question for Japanese chipmakers is whether they can hold on to their niche. The world's largest power chipmaker, Germany's Infineon Technologies, has 21 per cent of the global market, as much as the top five Japanese players combined.

Experts say Japanese chipmakers are relatively small, making it difficult to scale up production and marketing. Japanese manufacturers are also wary of making big investments lest their peers do the same and cause a glut.

Experts say consolidation is needed before Japan's share of the global market slips further - by 1.2 percentage points from 2020 to 2021.

Some are trying to turn words into action.

Fumiaki Sato is co-founder of Sangyo Sosei Advisory, a boutique investment banking firm that aims to set up a chip foundry to provide manufacturing services to all Japanese power chip makers. The idea, says Mr Sato, former vice-chairman of Merrill Lynch Japan, is to create a power semiconductor equivalent to that of Taiwan Semiconductor Manufacturing Co, the world's largest contract chipmaker.

"Every company invests in its production capacity. If they need more, they can come to us, "Sato told Nippon Kei Asia. He said it costs as much as 100 billion yen ($765 million) to build a single chip plant. "Companies see this as a risky undertaking, even at a time when demand is widely expected to grow. There is always a risk of oversupply."

Mr Sato is considering buying an old chip plant in Niigata, central Japan, from Onsemi of the US, a move that was subsidised by METI last year. But so far, the plan has not moved forward.

Mr Sato cites challenges such as securing more capital and potential customers.

One factor hindering capacity expansion is the nature of power semiconductors themselves. They are designed to handle high voltage equipment and are usually manufactured to individual product specifications rather than mass produced.

But Masao Taguchi, former head of Fujitsu's semiconductor business, said the industry could shift radically as mass production of electric cars begins, leading to the need for cheaper standardised chips. "Power semiconductors are likely to become more standardized, allowing companies that can scale up production to dominate the market," he said. "That's what happened in the DRAM market," he added, referring to Japanese chipmakers losing out to South Korean rivals in the memory chip market.

Germany's Infineon leads the race for scale. It operates two large 300mm wafer manufacturing plants, one in Dresden and the other in Filach, Austria. Denso's facilities will not come online until the first half of next year.

Toshiba is building two 300mm production facilities, with one scheduled to start production this fiscal year and the other in fiscal 2024. Mitsubishi Electric started mass production of 300mm wafers only in FY24.

Fujifilm, a major supplier to Toyota and Honda, says it does not chase market share but keeps a tight rein on its capital investment. It said it was preparing to develop a 300mm facility, but declined to elaborate on a time frame.

"Consolidation is unlikely to happen unless it is really necessary," said one industry official.

In the meantime, policymakers are watching the situation closely.

The Ministry of Economy, Trade and Industry held another meeting of its semiconductor industry strategy team on April 14 to discuss strategies to strengthen the power semiconductor industry.

Kazumi Nishikawa, head of METI's IT industry division, says demand for such semiconductors is expected to "grow fast" and "may outstrip supply".

The ministry recently offered subsidies to Japanese chipmakers to help them upgrade aging plants, but Nishikawa said this was a short-term solution, not a long-term one. "As a top producer of power semiconductors, Japan has a responsibility for supply to the rest of the world," he said.

He said the government is expected to draw up concrete support measures for the sector once a bill is passed to strengthen the country's economic security. The measures are expected to be part of next year's budget.

The ministry won a victory last year when it helped persuade Taiwan Semiconductor to build a chip plant in Kumamoto, southern Japan, but says more needs to be done. "We have successfully reached the starting line," Nishikawa said of the Taiwan Semiconductor deal. "The chip industry is moving so fast that if you stop trying, you fall behind."

One of the industry's biggest tasks will be to tackle Japan's keiretsu system, in which firms form tight ties and focus more on serving each other than the wider market. Breaking this system will be key to restructuring Japan's fragmented chip industry.

Mr. Taguchi, the former Fujitsu executive, sees Toshiba as the leader in creating Kaixia, the world's second-largest maker of flash memory. "Toshiba has a high profile around the world. It can be a rallying point for the semiconductor industry in Japan, "he said.

Wakabayashi, a professor at Tokyo University of Science and a member of the Ministry's strategy team, also stressed the importance of being competitive on a global scale.

"The main customers for power semiconductors are likely to be global automotive suppliers -- Denso, Bosch and Continental," says Mr Wakabayashi. "Denso keeps a good fighting force, but the others are all Europeans."