In-depth interpretation of wafer foundry business data:

The second half of 2023 is still a structural adjustment period for the entire semiconductor manufacturing industry, and TrendBank, based on the self-built wafer manufacturer market data Kanban, inferred that the end-to-end overall demand is really rising until the Q1 quarter of 2024.

Wafer foundry end: The industry is still in the trough period of volatility, and the new growth pole has not appeared

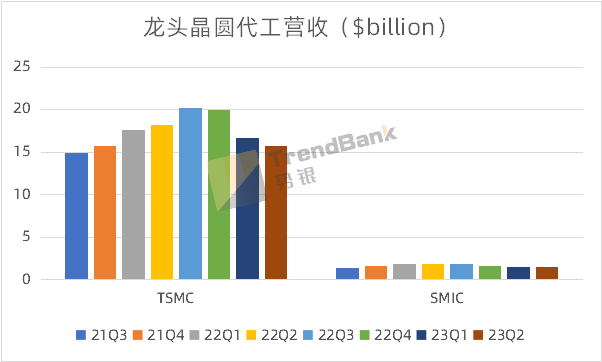

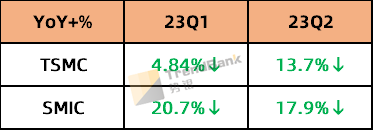

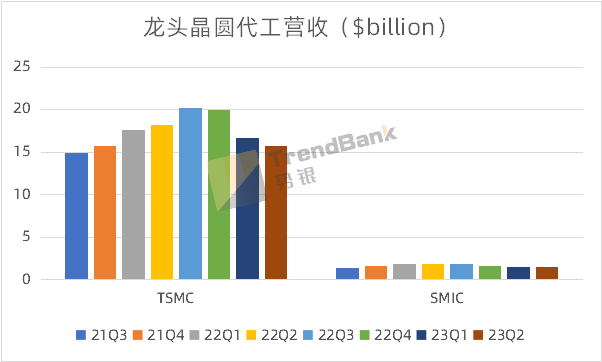

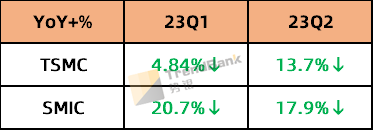

From the perspective of revenue data, the wafer foundry industry reached its peak revenue in the Q3 quarter of 2022, and then began to decline, and the total revenue of the two leading foundersdeclined by 9.3% and 19.2% respectively in the first half of 2023. 2023 Q2 TSMC revenue fell 13.7% year on year, further expansion and no signs of improvement, can explore the international semiconductor manufacturing industry is still in a downward cycle, it is expected that the decline in Q3 quarter will narrow, and reached the bottom, Q4 quarter in the "low-altitude flight" stage, 2024 began to turn the corner; Smic's revenue fell slightly in the second quarter of 2023, thanks to the Chinese government's domestic demand to stabilize the domestic economic situation, but the domestic semiconductor manufacturing industry will still be in a trough period of volatility.

Data source: TSMC, SMIC, TrendBank Statistics

Data source: TrendBank

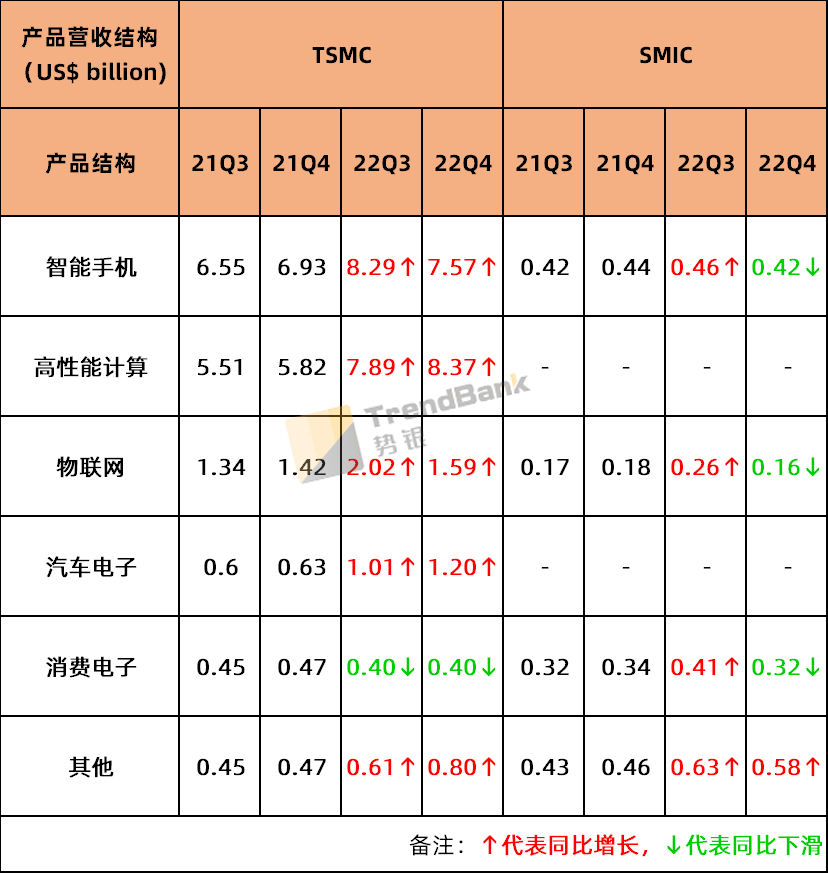

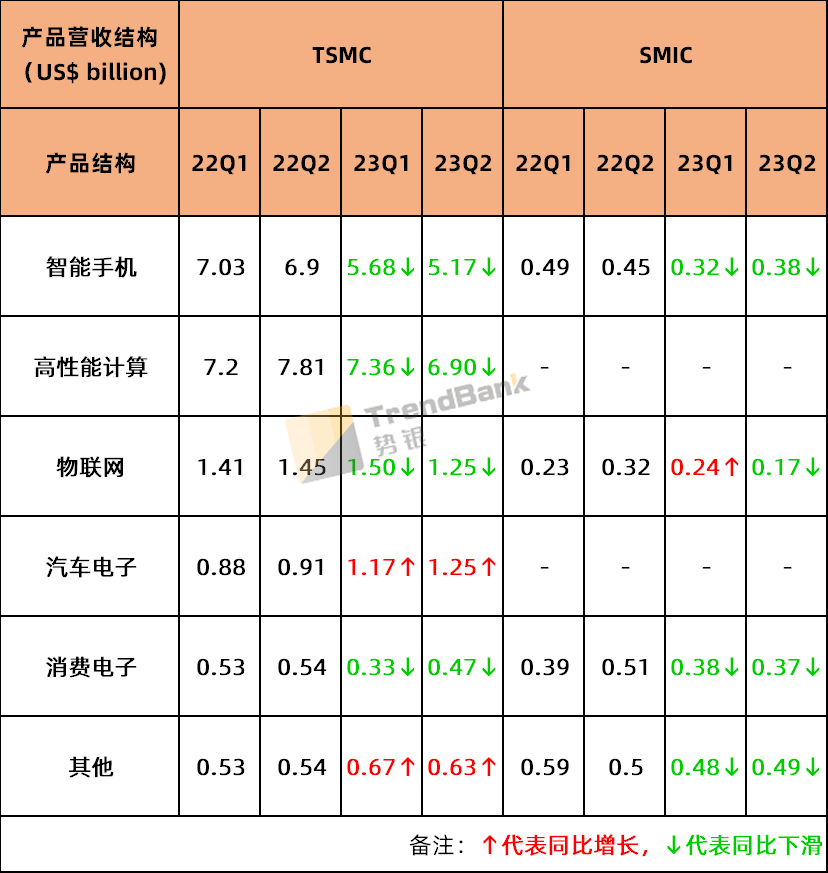

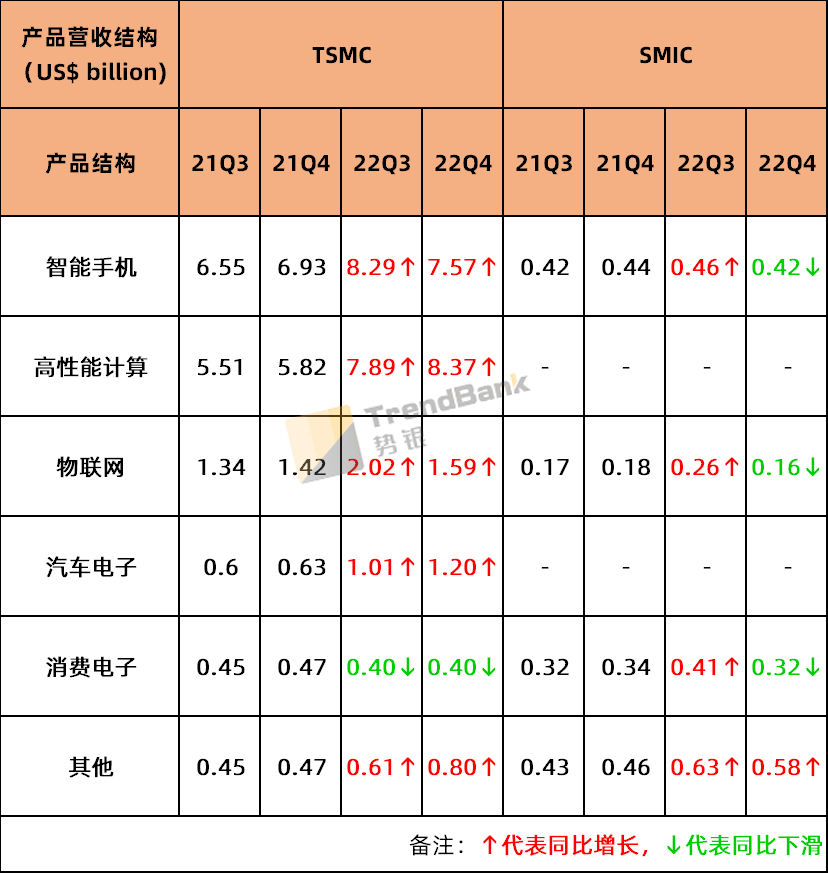

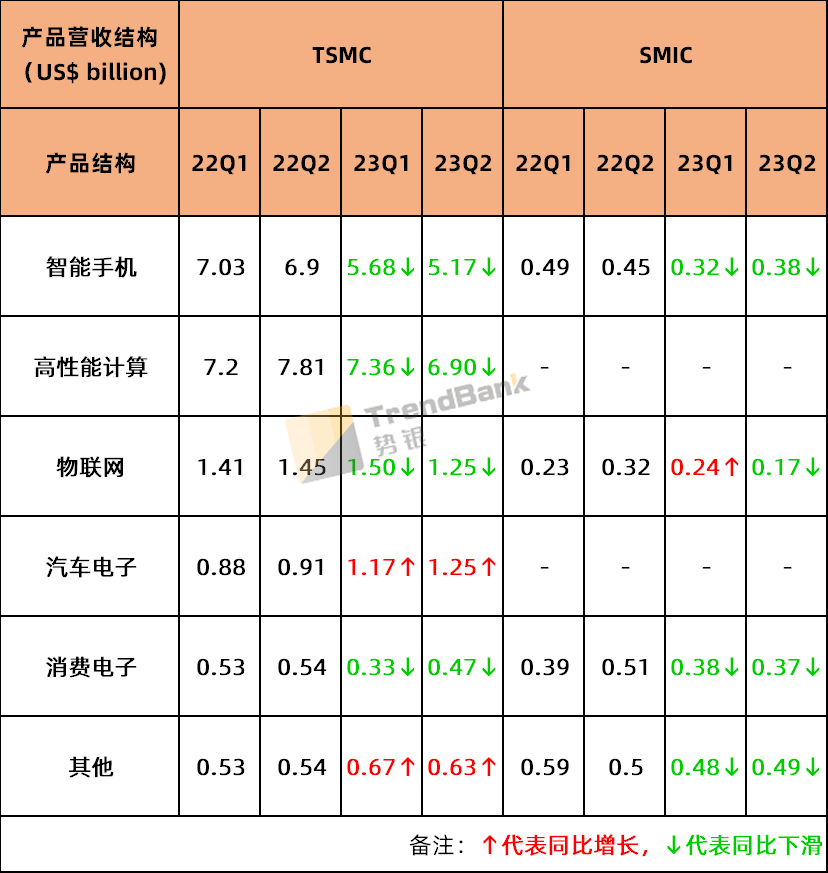

From the perspective of OEM revenue in the subdivided application field, the revenue of TSMC's consumer electronics sector in the third quarter of 2022 took the lead in a year-on-year decline of 11.1%, and the rest showed positive year-on-year growth. The cold of the international semiconductor manufacturing industry began to emerge from the consumer electronics sector, and then spread to the smartphone/smart home - industrial Internet of Things and other product sectors. Smic's revenue from various products began to decline to varying degrees in the Q4 quarter of 2022. In summary, the international semiconductor manufacturing industry began to show signs of decline as a whole in the quarter of 2022Q3, and China's semiconductor manufacturing industry began to show signs of decline as a whole in the quarter of 2022Q4.

Data source: TSMC, SMIC, TrendBank Statistics

It can be seen that in the second half of 2022, the wafer foundry market began to show a significant downward trend, and due to the semiconductor supply chain order scheduling there is a certain supply and demand lag, the entire semiconductor manufacturing industry entered the downward cycle from bottom to bottom in 2023. In-depth analysis of the product structure, taking TSMC as an example, only the automotive electronics sector revenue in 2023 Q1/Q2 quarter to achieve year-on-year growth, from the side confirmed that in the past two years, the entire wafer foundry capacity is occupied by smart phones/high-performance computing systems/consumer electronics and other products, automotive electronic chip production capacity is compressed, and now the demand for other applications is rapidly weakening. Automotive electronic chip production capacity can be filled, but combined with short-term supply and demand changes and the overall climate of the environment, the second half of 2023 global automotive electronic products will show a balance of supply and demand or even oversupply.

Data source: TSMC, SMIC, TrendBank Statistics

Application side: Automotive electronics support industry downturn, AI+ large model plate is still not hot

Application side demand weakened the pressure on the upstream semiconductor manufacturing industry, smartphone/consumer electronics/Internet of things industry demand has weakened significantly, although the second half of the year Huawei launched Mate 60 series products, can stimulate the smartphone market in the short term, but the overall trend of "low-altitude flight" in the industry remains unchanged. The concept of AI+ large model has remained hot in the past two years, but the actual industrial investment scale in the application field has not formed, and it has encountered the impact of the overall economic downturn, the chip demand for AI+ large model is lukewarm, and its chip performance requirements are high, and there are fewer manufacturers capable of chip design and wafer processing and manufacturing. Therefore, the application field will need to wait for the overall recovery of the semiconductor manufacturing industry to develop.

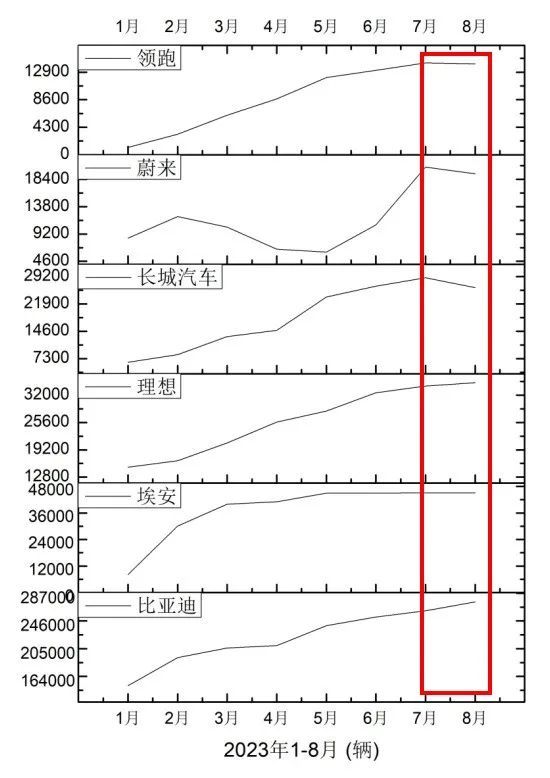

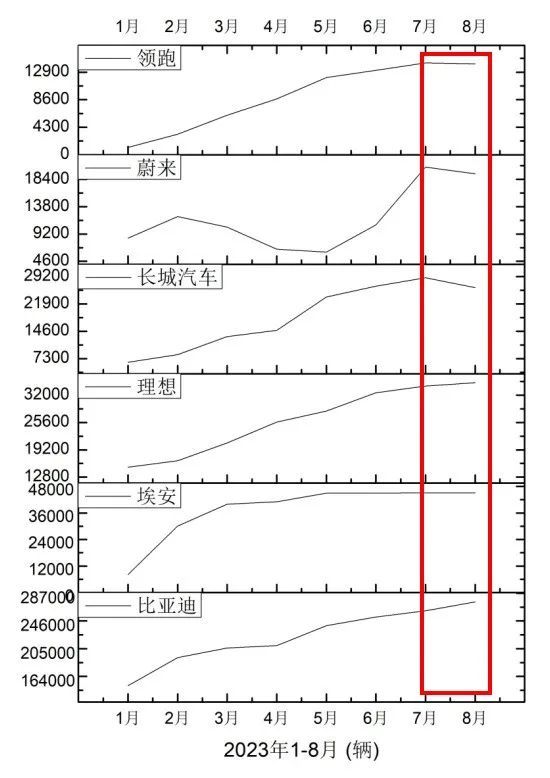

Automotive electronics benefit from the current chip production capacity vacancy and the state's strong support for the development of the new energy automobile industry, and the application demand is still strong in the first half of 2023. With the gradual release of automotive chip production capacity, chip supply and demand have been alleviated, and in the second half of the year, the sales growth of new energy vehicles of several traditional car companies and new automobile forces have shown a narrowing trend to varying degrees. The weakening of application demand will make the end-to-end supply and demand relationship of automotive chips begin to stabilize, and even there will be fluctuations in oversupply. It can be said that with the arrival of the peak demand for automotive electronics in the second half of the year, the entire semiconductor manufacturing and application side will gradually show a state of supply and demand balance, and after the trough adjustment period, a new round of demand upcycle will be entered in 2024.

2023 domestic new energy vehicle sales trend

Data source: TrendBank Statistical Chart

With the improvement of the prosperity of many industries and the overall recovery of the global economy, the semiconductor manufacturing industry began to recover in the Q1 quarter of 2024, and the AI+ large model application market will gradually form the scale effect of "capital + industry", which will become a new growth pole for the development of the semiconductor manufacturing industry.