On August 14, Semiconductor Intelligence released the top 15 semiconductor vendors by sales for the second quarter (Q2) of 2023. According to the report, Intel ranked first ($12.9 billion), Samsung Electronics ($11.2 billion) was second, and Nvidia ($11 billion) was third.

However, I am a little unhappy with this ranking. The two complaints are as follows.

1) TSMC is not included in the sales ranking

2) NVIDIA's fiscal year is different, so $11 billion in sales is written as "forecast"

First, the sales of foundries such as TSMC are included in fabless companies that outsource production to TSMC, so Gartner et al. do not include foundries in the rankings to prevent double counting. On the other hand, organizations such as IC Insights have published rankings that clearly point to no fabs and foundries.

While I don't understand either case, I want to understand TSMC's position and it has become so huge that I am willing to support the IC Insights ranking system.

The real number one is TSMC

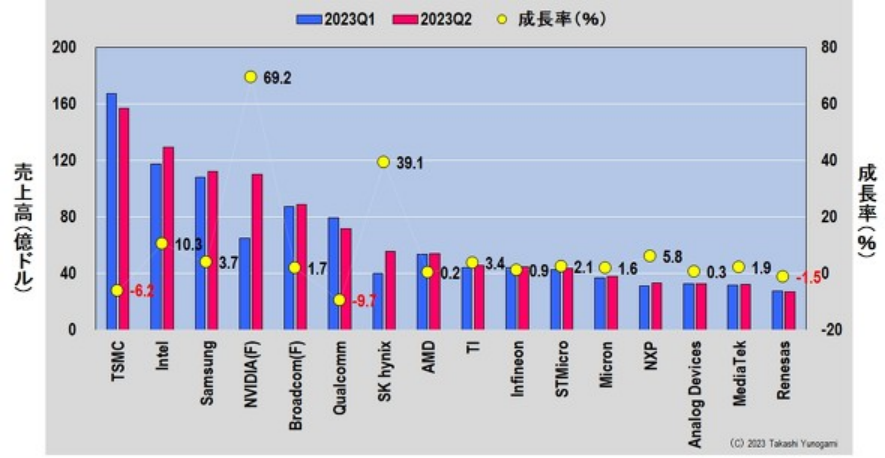

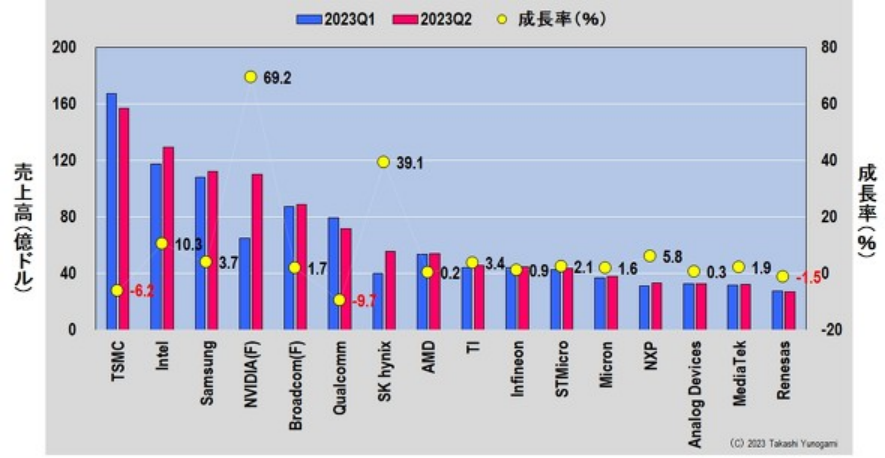

Therefore, I looked at TSMC's Q2 2023 financial report, and based on that, I produced a ranking of semiconductor vendors' sales in Q2 2023 (Figure 1).

As a result, TSMC ranked first ($16.7 billion), followed by Intel in second place, Samsung in third place, and Nvidia in fourth place (estimated). Unsurprisingly, TSMC is No. 1. In addition, Renesas Electronics (No. 16) is the only Japanese manufacturer on the list, with Kaixia and SONY seemingly missing from the list.

It is worth noting here that the growth rate from the first quarter to the second quarter of 2023 is 69.2% for fourth-ranked Nvidia and 39.1% for seventh-ranked SK Hynix. The background is the explosive spread of generative AI (artificial intelligence) such as ChatGPT around the world, and NVIDIA's GPU is sought after by the market as the AI semiconductor used in it. In addition, NVIDIA Gpus use HBM (High bandwidth memory) as memory. It can be interpreted that SK Hynix, the largest manufacturer in the market share, has benefited from this and achieved a high growth rate.

So where does NVIDIA, which ranked fourth in its forecast, actually rank? Below, let's take a closer look at NVIDIA's performance. Based on this, I would like to guess NVIDIA's true ranking.

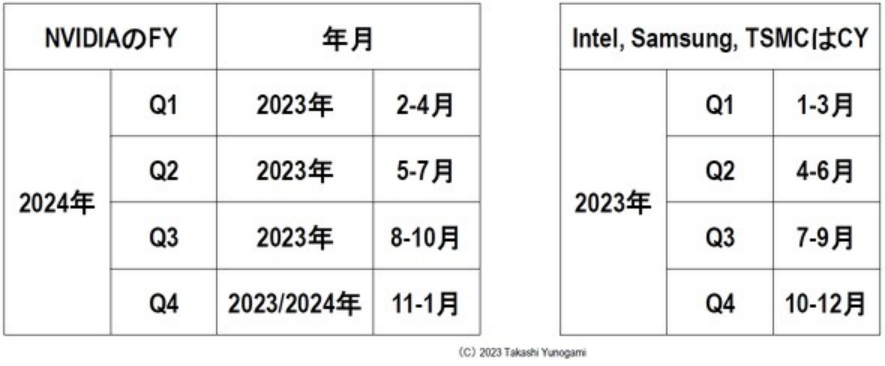

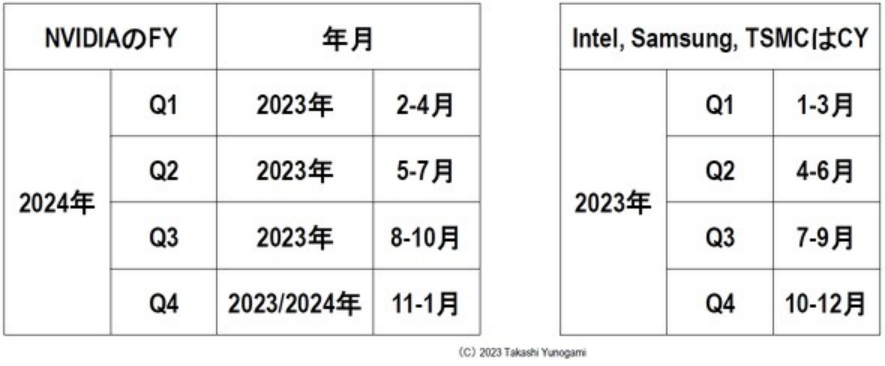

NVIDIA's sales by business area

First, let me explain that NVIDIA's fiscal year (FY) is different from the calendar year (CY) used by TSMC and Intel (Figure 2). For example, NVIDIA's FY2024 Q1 is actually from February to April 2023 and FY2024 Q2 is from May to July 2023. As a result, because NVIDIA's fiscal year FY is different from CY, Semiconductor Intelligence, which publishes a ranking of semiconductor vendor sales, is likely to use NVIDIA's sales as a "forecast."

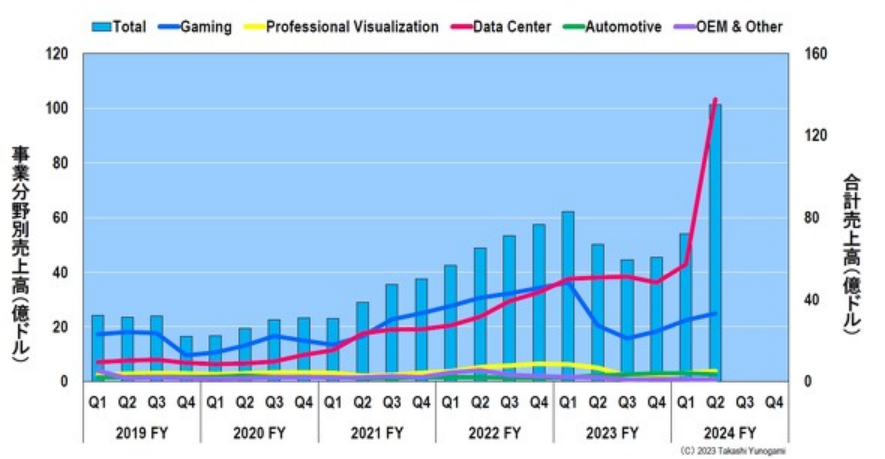

Next, let's look at NVIDIA's quarterly sales by business area, keeping in mind that NVIDIA's fiscal year FY is different from CY (Figure 3).

NVIDIA's Gpus are semiconductors originally developed for image processing. As a result, gaming applications that require graphics processing will be the main source of revenue until around fiscal year 2022. However, starting in fiscal 2023, data center usage surpassed gaming usage and saw significant growth from Q1 ($4.28 billion) to Q2 ($10.32 billion) in fiscal 2024.

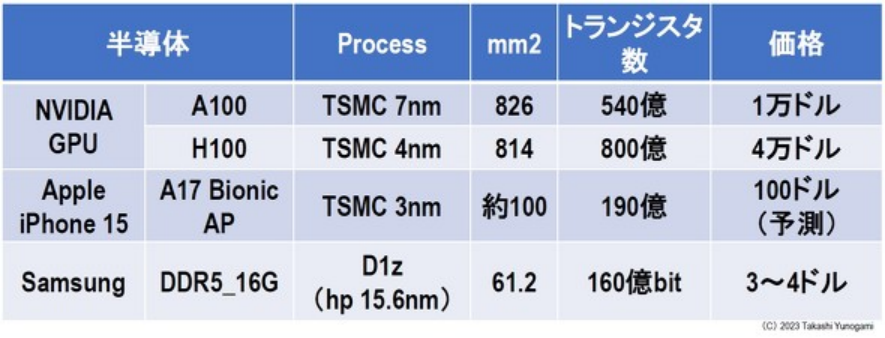

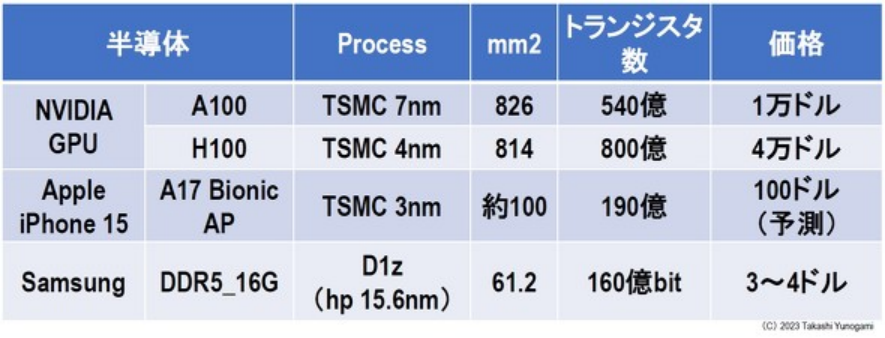

The Gpus in the data center are AI semiconductors used in generative AI such as ChatGPT. Currently, generative AI development requires NVIDIA's "A100" and "H100."

"A100" and "H100" are both monster chips with chip sizes of more than 800mm 2, close to the exposure limit. The A100 costs $10,000 and the H100 costs $40,000.

For example, the "A17 Bionic" processor of the "iPhone 15" series, released this year, has a chip size of about 100 mm 2 and a price of about $100, while memory manufacturers such as Samsung use the most advanced DDR5_16Gbit DRAM they manufacture chips with a size of 61.2mm 2. The cost is only $3 to $4. From this comparison, you can see how extraordinary the "A100" and "H100" are (Figure 4).

NVIDIA could be second after TSMC

Regarding quarterly sales, it is not possible to directly compare TSMC, Intel, and Samsung using CY with NVIDIA using FY.

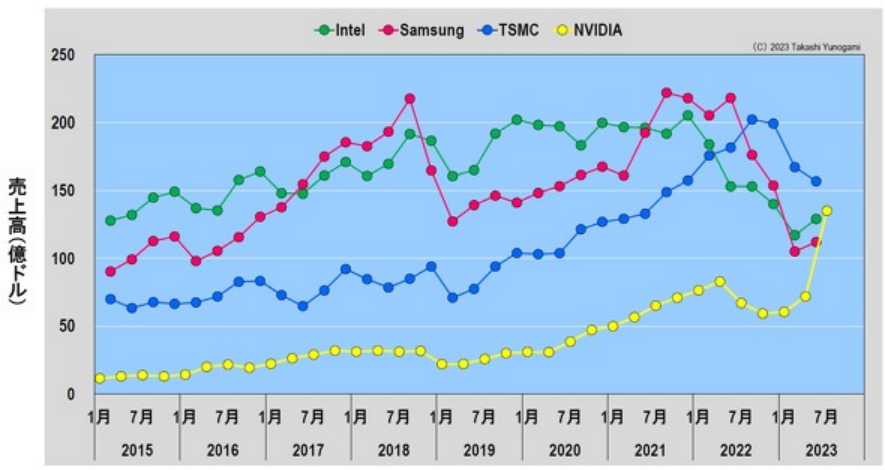

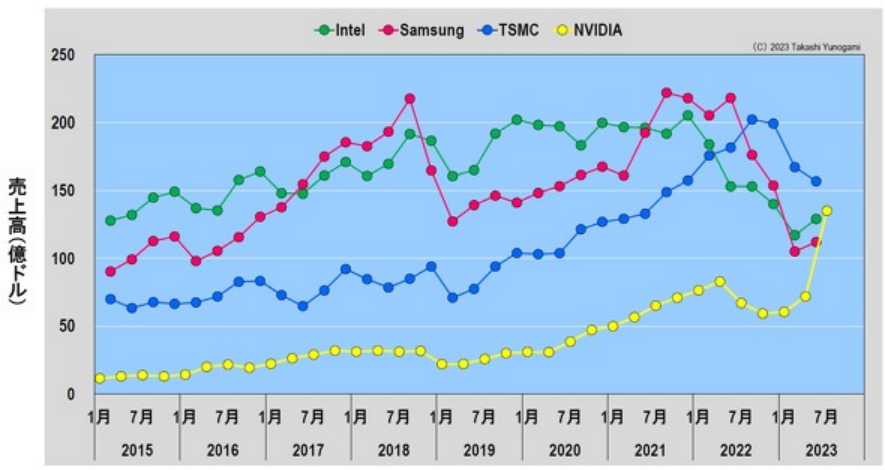

So for CY like TSMC, we plot sales for March, June, September, and December (the last month of quarterly results), while for NVIDIA, we plot sales for April, July, and December, the last month of FY. I created a chart to plot January sales (Figure 5).

Intel held the No. 1 spot until March 2017, but Samsung, which grew rapidly due to the memory bubble, jumped to No. 1 between June 2017 and September 2018. But since then, the memory recession has hit, and Intel has returned to the top spot since December 2018.

After that, this situation continued for a while, with Intel ranking first and Samsung second, but due to the special demand of the novel coronavirus, Samsung ranked first again in September 2021 and remained in the top position until June 2022. However, if the particular coronavirus demand starts to collapse in 2022, Intel's sales will start to decline rapidly from December 2021, and Samsung's sales will start to decline rapidly from June 2022. On the other hand, TSMC, which has been growing steadily since 2019, leapfrog both companies to the top spot in September 2022. TSMC's sales have also fallen sharply since December 2022.

In this case, NVIDIA saw a significant increase in sales from April 2023 to July of the same year. Although a direct comparison is not possible due to a one-month difference in financial statements, it can be seen from Figure 5 that around June to July 2023, TSMC will rank first, Nvidia second, Intel third, and Samsung fourth.

Moreover, if TSMC's sales continue to decline after September 2023, it is not impossible for Nvidia, with sales of $16 billion in October of the same year, to jump to the top. That means NVIDIA, founded in 1993, will top the semiconductor sales list for the first time in its history.

Nvidia is number one in the world

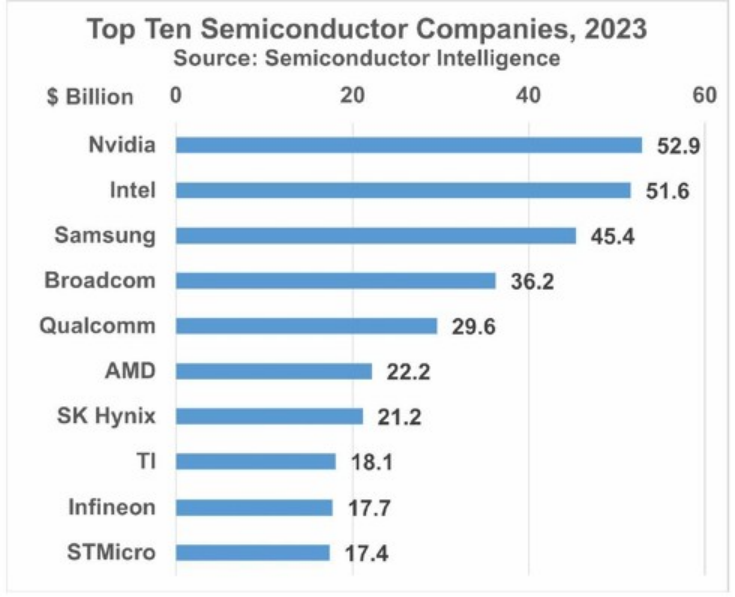

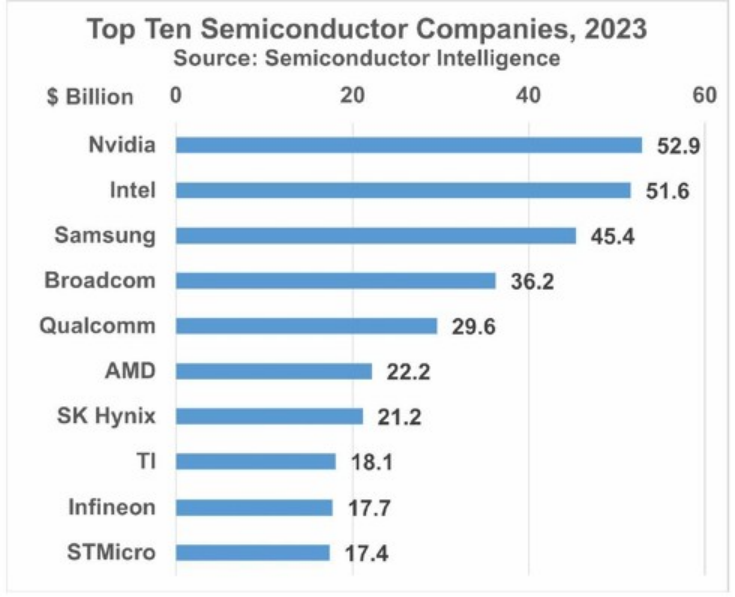

Just as you might imagine, Semiconductor Intelligence released its forecast for the top 10 semiconductor manufacturers by sales in 2023 on September 21 (Figure 6). And then...

Oh, NVIDIA is number one! Intel ranked second and Samsung third.

However, Semiconductor Intelligence still uses Gartner's methodology for its ranking and does not include contract manufacturing company TSMC. As I mentioned at the beginning, I am not satisfied with this point.

Thus, in the Bloomberg article "TSMC cuts 2023 sales forecast - Arizona operation delayed to 2025" (July 20, 2023), "TSMC's main customers are Apple and Nvidia, TSMC's 2023 sales are calculated based on the forecast of sales "by 2023 (2023) will be reduced by 10% to $75.88 billion ×0.9= $68.29 billion."

Even with a 10 percent decline, TSMC's $68.29 billion in sales still beats NVIDIA's $52.9 billion. Therefore, the forecast 2023 sales ranking is first TSMC, second Nvidia, third Intel, fourth Samsung.

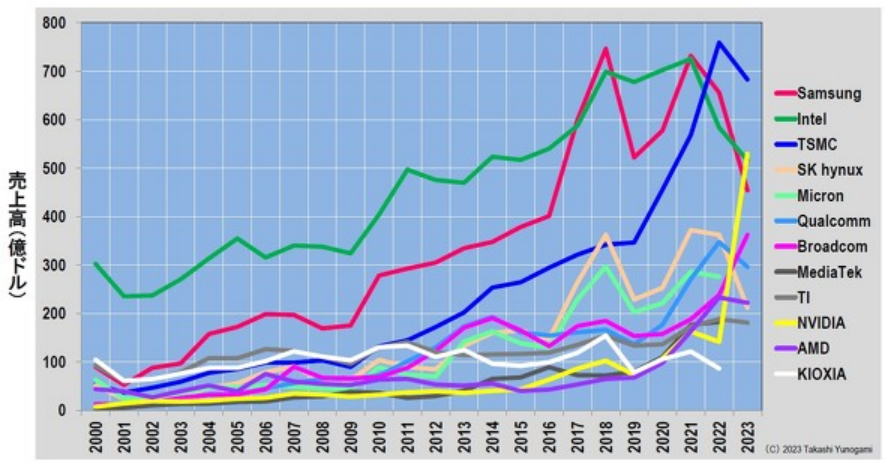

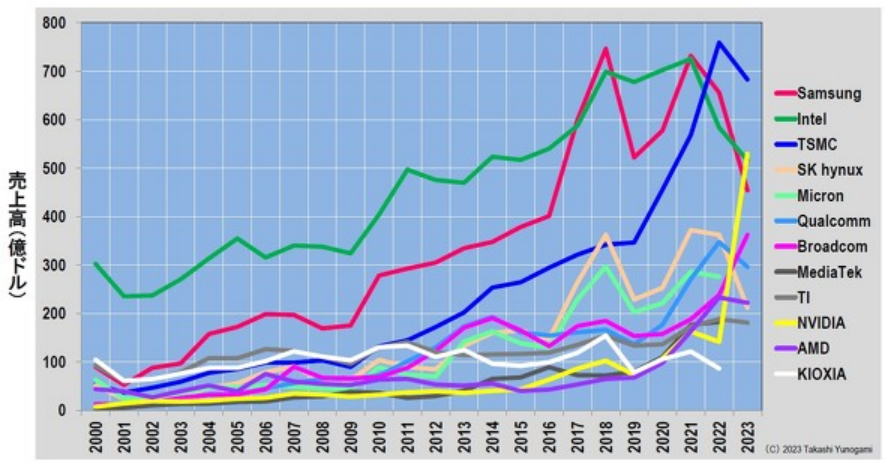

Here, we create a chart of sales trends for major semiconductor manufacturers from 2000 to 2023 (Figure 7). Since 2010, Intel, Samsung and TSMC have been called the "Big Three". Since 2017, the big Three have pitted themselves against each other, and TSMC has come out on top in 2022.

From 2022 to 2023, Nvidia sales will rapidly expand by 3.8x, surpassing Intel and Samsung, ranking second (projected), only behind TSMC. If Nvidia's phenomenal growth continues, overtaking TSMC for No. 1 May not be a dream.

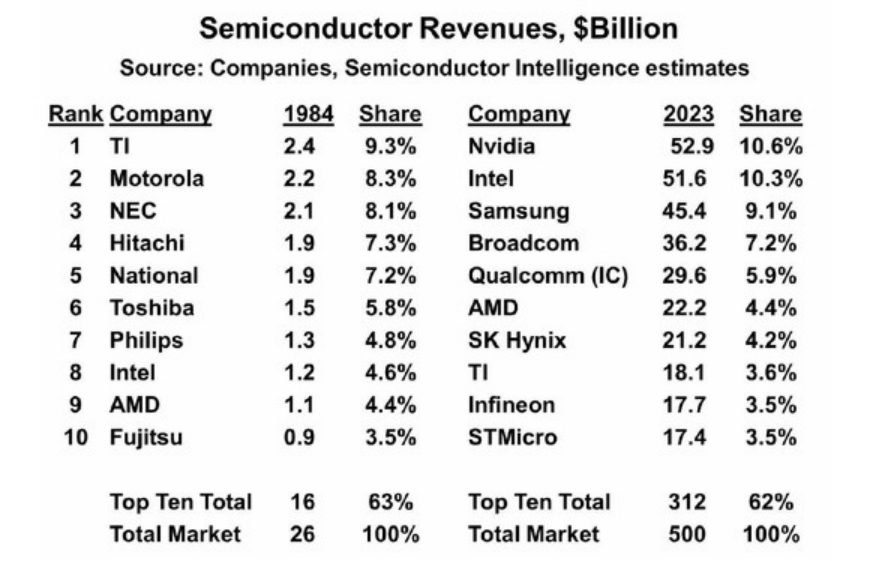

A comparison between 1984 and 2023

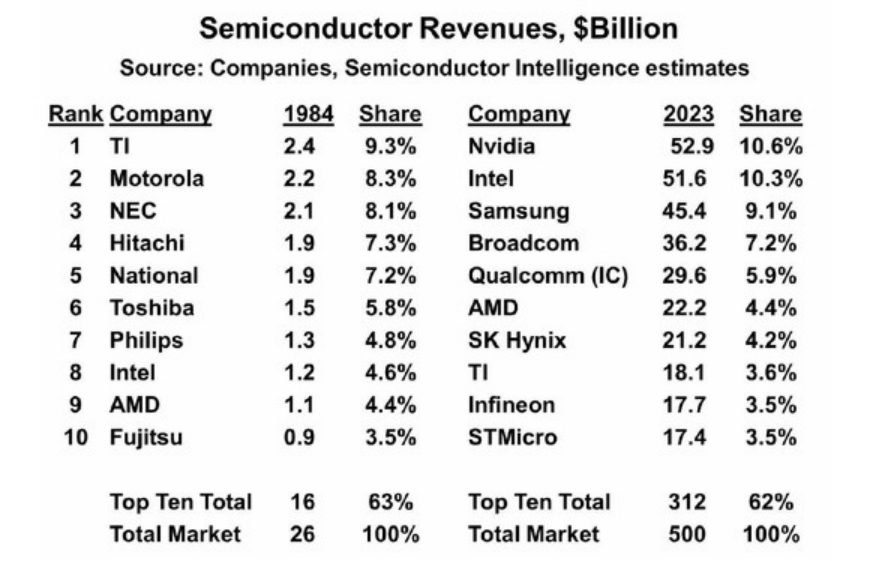

The semiconductor intelligence article mentioned above has some very interesting information. Semiconductor Intelligence began analyzing the semiconductor industry in 1984. Therefore, he compared the years 1984 and 2023 (forecast) of the top 10 semiconductor manufacturers by sales (Figure 8). What have we learned?

1) The top 10 companies in 2023 have all been in business for more than 30 years.

Semiconductor Intelligence notes that this result "comes despite the semiconductor industry's rapid pace of development and numerous emerging companies," and that "NVIDIA is the youngest, at 30." Although there have been breakthrough cases like Nvidia in recent years, it will take more than 30 years for it to become a top semiconductor company. That means you can't expect to be in the top 10 in five to 10 years.

2) The rise of fabless and the role of TSMC

In 1984, the top 10 companies were all vertically integrated (IDM) companies, but by 2023, there will be four fabless companies in the top 10 (NVIDIA, Broadcom, Qualcomm, and AMD). In addition, Intel, SK Hynix, Texas Instruments (TI), Infineon Technologies, and ST all use external foundry (SK Hynix outsources the production of SSD controllers to TSMC).

These foundries include TSMC, Samsung, GlobalFoundries, UMC and SMIC, but the top 10 companies include four fabless companies and five companies that use outside foundries, for a total of nine companies, all of which outsource production to TSMC. In short, without TSMC, there would be no semiconductor industry.

3) The total market share of the top 10 companies remained unchanged

Over the past 39 years, the semiconductor market has grown about 20-fold, from $26 billion to $500 billion. However, the combined market share of the top 10 companies will not change much, rising from about 63% in 1984 to about 62% in 2023. In response, Semiconductor Intelligence said, "Leading companies are relatively stable."

However, the composition of the head firm has changed significantly. Only three companies made the top 10 in 1984 and 2023: TI, Intel, and AMD. The Japanese companies that were in the top 10 in 1984 (NEC, Hitachi, Toshiba, Fujitsu) will not be in the top 10 in 2023.

The lesson learned is that semiconductor manufacturers must evolve to survive.

Grow or disappear

Japan's EE Times' Manufacturing Editor Headlines (September 25, 2023) has an interesting description.

"There are three types of semiconductor manufacturers: large, niche or gone. Intel is too big to be a niche manufacturer, so it has no choice but to remain a 'supergiant.'"

NVIDIA, the main company in this article, was founded 30 years ago, in 1993 as a developer of 3D graphics ics for games and multimedia, and in 1999 as a GPU. I think Gpus were a niche market at the time.

NVIDIA entered the AI semiconductor market in 2012, TSMC developed a GPU-specific package called CoWoS, and 10 years later, the AI semiconductor market exploded. As a result, NVIDIA is expected to surpass "super giant" Intel in sales.

What can we say from here? In order to survive in the semiconductor industry, does that mean you have to grow, be it big or niche? Growth here is defined as "increasing sales while increasing profits."

In this case, the above description of "Notes on manufacturing edits" could be rewritten as follows.

"There are two types of semiconductor manufacturers: grow and survive, or disappear." The lesson may not be limited to semiconductor manufacturers. The definition of growth needs to change over time and circumstances, but doesn't it apply to all industries, organizations, and individuals?

Is your company growing? And you're growing up?