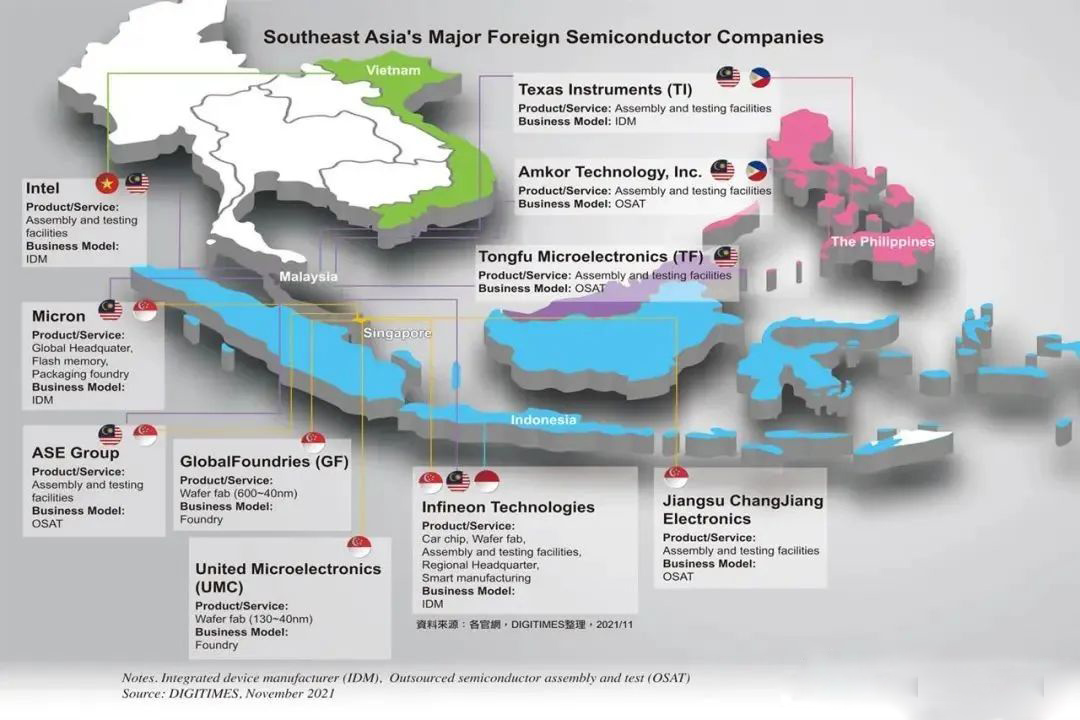

Under the superposition of many factors, the global semiconductor industry is also facing new fluctuations, and Southeast Asia has become the "focus" of fluctuations.

Although the semiconductor industry in Southeast Asia is at the low end of the industrial chain, it plays a crucial role in the division of labor in the global chip industry chain. An estimated 15-20% of the world's passive components are manufactured in Southeast Asia, which is also an important testing and packaging hub for technology companies, accounting for 27% of the global semiconductor packaging market. According to statistics, the chip market size of Southeast Asian countries is about $27 billion in 2020 and is expected to reach about $41.1 billion in 2028.

Southeast Asia semiconductor industry supply chain

(Photo credit: DIGITIMES)

Tracing the driving force behind industrial fluctuations, in addition to the key factors of demographic dividend and cost, under the influence of international geopolitical conflicts, Sino-US trade frictions and other factors, the guarantee of supply chain security has gradually become a consensus, and further catalyzed the diversion, migration, fluctuation and adjustment of the global electronic industry chain.

From the United States and ZTE Huawei event in 2018 set off sanctions against China, to the United States "Chip Act" set off a wave of global chip industry development competition, and then in January this year, the new agreement between the United States, the Netherlands and Japan once again expanded chip export control measures to China. A series of fluctuations have accelerated semiconductor manufacturers' search for "China alternatives" in Southeast Asia to fill the supply gap caused by U.S. attempts to separate the Chinese mainland from the chip market.

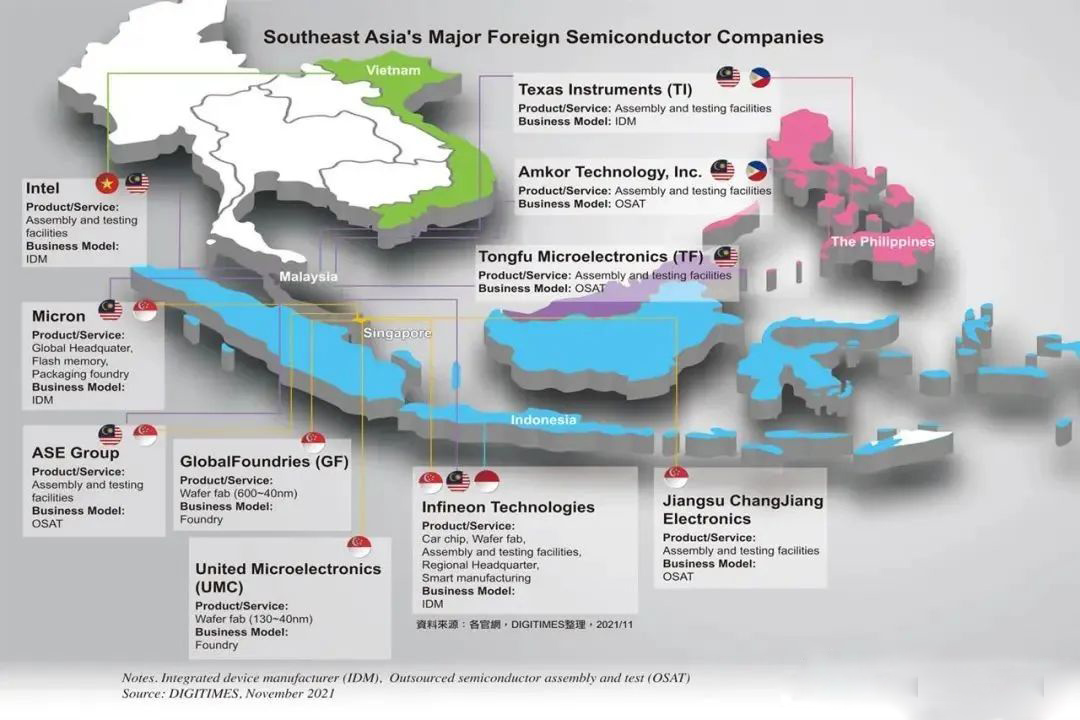

In this process, many players, including industry giants, have been layout in Southeast Asia, while part of China's semiconductor industry chain has gradually moved to Southeast Asia. Countries such as Singapore, Malaysia, Vietnam, Thailand, the Philippines and India are benefiting greatly from the global reordering of the semiconductor industry.

Semiconductor manufacturers flocked to Southeast Asia

In recent days, major US chip equipment makers have been shifting operations from China to Southeast Asia, indicating that US export controls have accelerated the technology decoupling of the world's two largest economies.

Together, Applied Materials, Pan Forest and Kolei control about 35 percent of the global semiconductor equipment market. Since the U.S. government introduced sweeping export controls in October last year, restricting China's access to equipment and manpower to make advanced chips, the three companies have moved non-Chinese employees from China to Singapore and Malaysia or increased production capacity in Southeast Asia, Nikkei Asia reported.

Export controls have reduced the business of American companies in China and are a key factor in their industrial relocation. According to SEMI data, China once accounted for nearly 30% of the revenue of US chip equipment makers, but in the latest quarterly results, Ying Material fell to 20%, Fanlin 24%, and Klei 23%.

The company's strategy to be geographically close to its customers has led it to invest throughout Asia, including new technology production facilities in Malaysia, technology centers in South Korea, and engineering facilities in India, the company said. "Due to macroeconomic headwinds, recent trade restrictions that have limited our ability to do business in China, and an expected decline in global wafer manufacturing equipment spending in 2023, we are taking a number of steps to manage costs."

"Given the current geopolitical pressures, our presence in Southeast Asia is increasing." Coley also expressed.

In addition, semiconductor manufacturers such as Samsung, Intel, GF and UMC all have factories in Southeast Asia and plan to expand further there.

Among Southeast Asian countries, Singapore's human capital, infrastructure and business-friendly environment make it a natural port of call. The Philippines, Malaysia, Thailand, and Vietnam have skilled labor and talent bases that can support the back-end manufacturing of complex chips.

Nowadays, with changes in the international geographical pattern and industrial environment, Southeast Asia is becoming a "treasure" for chip giants to bet on.

Singapore: Complete industrial chain

In previous articles, the author described the development process of Singapore's semiconductor industry from start - boom - decline - recovery.

In 2020, the share of Singapore's semiconductor industry output value will increase to 46.3%. In just a few years, Singapore's semiconductor industry has achieved remarkable growth. In the subsequent development process, industry manufacturers have re-locked their eyes on Singapore.

Singapore is home to Micron's global headquarters, three memory fabs, and an assembly and test facility. It is also home to Infineon's Asia-Pacific headquarters, which manages research and development, supply chain, marketing and sales. ST, Avango, Mediatek and distribution giants Avnet and Fortune have factories and distribution networks in Singapore.

In addition, in the wafer manufacturing sector, Singapore has GF, UMC, SSMC, Soitec, Siltronic and other enterprises; In the equipment sector, there are large-scale production bases such as ASM and KLA, and equipment factories such as Edwan, Terida, TEL, Fanlin Group, and applied materials also have larger regional headquarters in Singapore; In the closed test link, ASE, Amkor, Changdian Technology and other closed test factories have factories in Singapore.

According to the data, Singapore currently has 40 IC design companies, 14 silicon fabs, 8 fabs, 20 encapsulation companies and some related companies responsible for materials, manufacturing equipment, photomask and other industries. IC insights data pointed out that Singapore accounted for nearly 5% of the world's fab capacity in 2021 and accounted for 19% of the global semiconductor equipment market.

The participation of these manufacturers has once again provided impetus for Singapore Semiconductor.

The reason is not difficult to find, because the Singapore government recognized earlier than other countries the core importance of the semiconductor industry as a high-tech manufacturing industry and the backbone of the entire electronics industry. With tax incentives, a professional regulatory framework, and a robust intellectual property (IP) regime, combined with a relatively large pool of well-educated workers and engineers, Singapore has attracted many multinational companies.

Singapore has announced billions of dollars in semiconductor-related investments in the past year or two and has set a goal of growing its manufacturing sector by 50 percent by 2030.

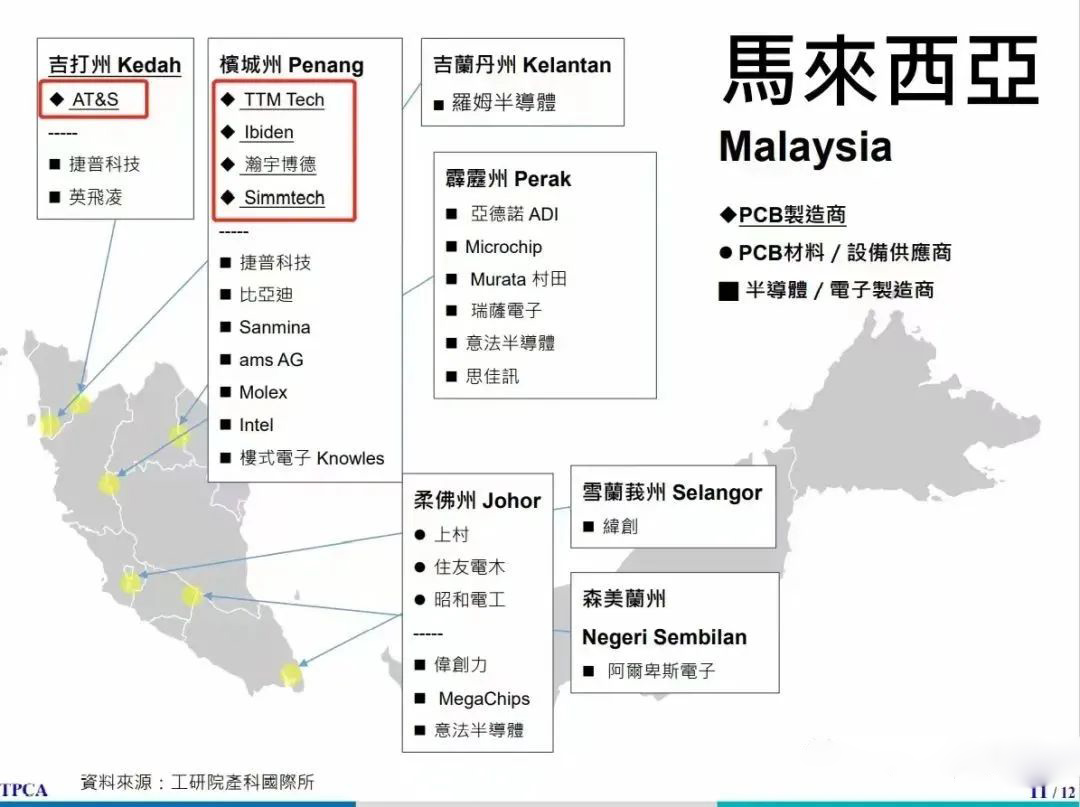

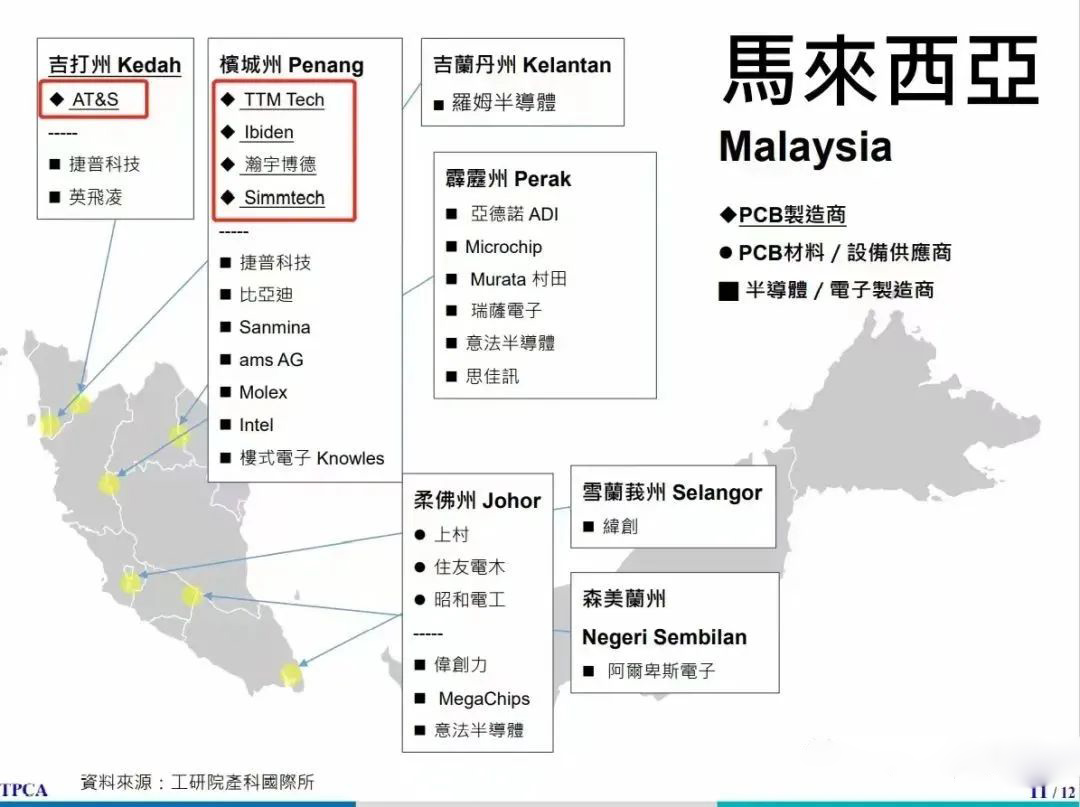

Malaysia: Closed test town

Malaysia plays an important role in the packaging and testing segment of the semiconductor industry chain. It is understood that Southeast Asia's market share in the global closed test is 27%, of which Malaysia monopolizes half.

Industry IDM giants such as Intel, Micron, TI, etc., have set up assembly and test facilities in Malaysia. In addition, major outsourced testing companies, including ASE Group and Tongfu Microelectronics, have also set up factories in Penang, Malaysia.

Among them, Penang, Malaysia is known as the Silicon Valley of the East, with more than 50 years of electrical and electronics industry development history, has become Malaysia's leading electronics industry center. According to SEMI data, Penang, Malaysia accounts for about 8% of the global semiconductor industry's back-end production, making it the world's leading microelectronics assembly, packaging and testing region.

In November last year, ASE broke ground on a new chip assembly and test facility in Penang, Malaysia, with ASEM's new facility focusing on high-demand packaging product types, including copper clips and image sensors.

In addition to the field of closed test, Malaysia also has a number of components and power semiconductor production plants.

MLCC announced in September 2022 that it will invest approximately 18 billion yen to build a new MLCC plant at its subsidiary in Sarawak, Malaysia, which is expected to be completed by March 2023.

In July 2022, Infineon held a ground-breaking ceremony for its new state-of-the-art fab in Kulin, Malaysia, which will significantly increase the company's SiC and GaN power semiconductor manufacturing capacity with an investment of over RM8 billion and is expected to be completed in the third quarter of 2024.

According to statistics, Malaysia has about 50 multinational semiconductor companies in the local closed test plant, fewer local companies, most of the multinational companies, including NXP, Broadcom, Micron, Italy, Infineon, Texas Instruments, ON Mei, ASE and so on. Malaysia's semiconductor industry is striving to move up from cheap foundry to design and manufacturing.

In recent years, Malaysia has also approved a total of RM95 billion (about 140 billion yuan) of new investment projects for multinational microelectronics companies. In the first half of 2022, 25 new projects related to the semiconductor industry chain were approved, with a total investment of RM9.2 billion (about 13.9 billion yuan), and investors included well-known enterprises such as AMD, Texas Instruments and Rohm.

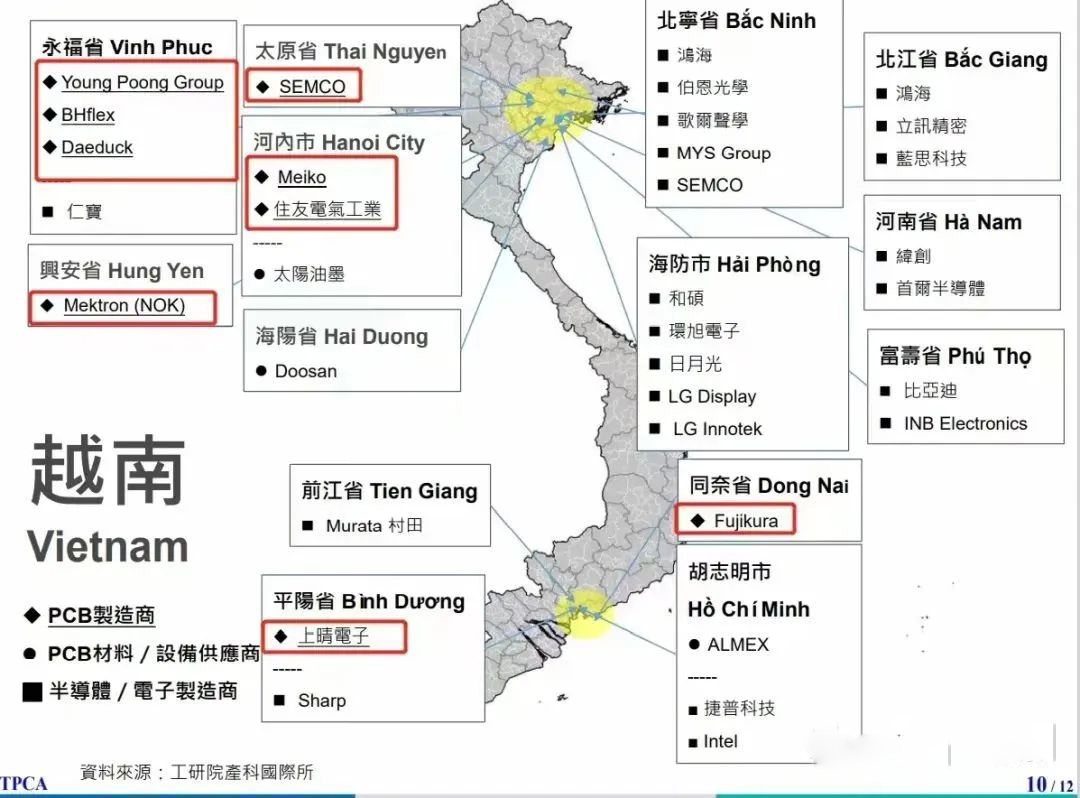

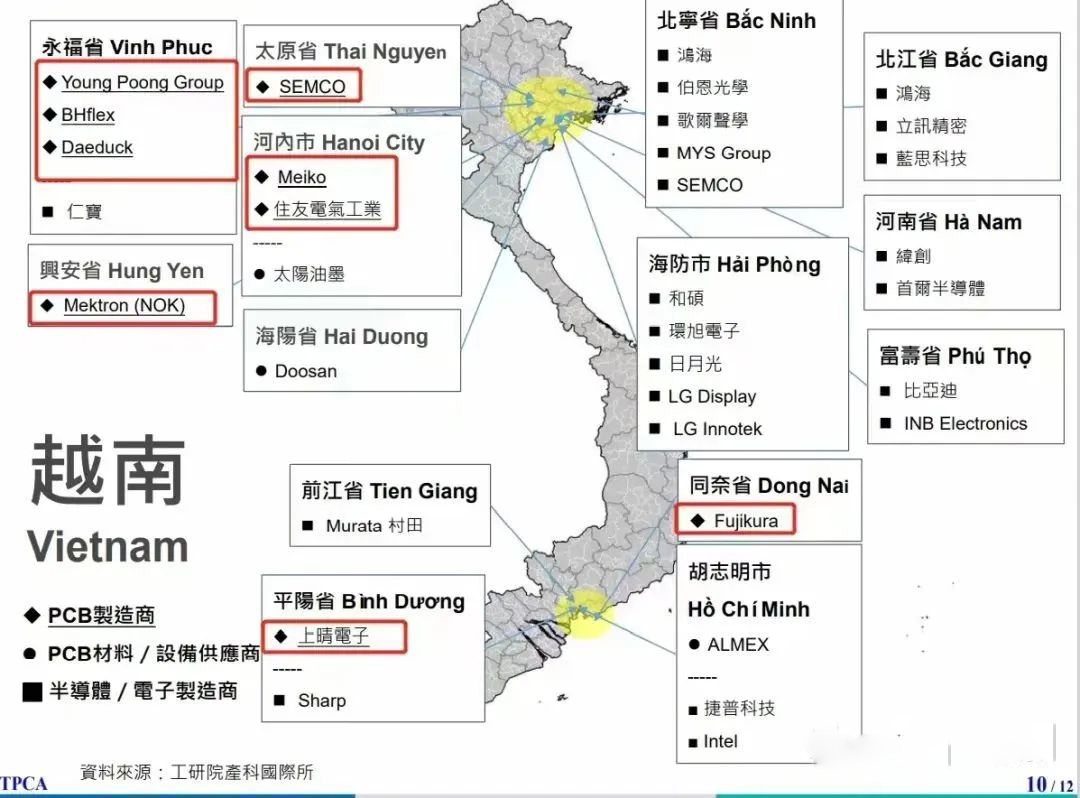

Viet Nam: Accelerated transfer

Currently, Vietnam's semiconductor industry is growing rapidly at all stages of the supply chain.

In early 2021, Intel injected $475 million into its Vietnam operations to build high-tech chip testing and packaging facilities at the Saigon High-tech Park. Intel invested $1 billion years ago to build a chip assembly and test plant in Vietnam, which is still an important production base for Intel Group.

In the same year, South Korean tech giant Amkor Technology signed an agreement to build a $1.6 billion semiconductor manufacturing plant in Bac Ninh province.

In August last year, Samsung Electronics announced an $850 million investment to manufacture semiconductor components in Vietnam, an investment that will make Vietnam one of four countries, along with South Korea, China and the United States, to produce semiconductors for the world's largest memory chip maker.

Also investing in Vietnam is EDA software giant Synopsys, which is moving its investment and engineering training from China to Vietnam. There are also companies like Renesas, Applied Micro, Splendid, Sonion, etc., but they are all relatively small projects so far.

With the support of a number of international semiconductor giants, Vietnam's semiconductor industry is also expected to achieve rapid development. According to a report by Technavio, the compound annual growth rate of Vietnam's semiconductor industry will reach 19% from 2020 to 2024, and the industry scale will be $6.16 billion in 2024.

So far, Vietnam's semiconductor industry is still dominated by packaging and testing, and the gradual shift of the generally low-margin closed test industry out of China has also given them opportunities. According to a report released by market research firm Technavio, Vietnam's semiconductor market will grow by $1.65 billion from 2020 to 2025, with an annual growth rate of 6.52%.

Vietnam also has one of the most open economies in the world, with 15 free trade agreements. According to VKFTA information, Vietnam has eliminated 31 tariff lines imposed on South Korean electronic products and components, which has also prompted South Korean semiconductor giant Samsung to set up a factory in Vietnam.

Although Vietnam's semiconductor industry chain is relatively weak at present, Vietnam has the convenient geographical advantage of bordering China. As well as the industrial chain formed by the Japanese and South Korean automobile manufacturers to set up factories in the local area, it has attracted the investment of electronic manufacturing manufacturers and is moving towards the capital-intensive and technology-oriented electronic technology industry settlement. Local enterprises in Vietnam are also more actively invested in the IC industry, including capacity expansion, mergers and acquisitions, etc., and will become an important part of the semiconductor market in the future.

For the prospects of Vietnam's semiconductor industry, its advantages lie in a large number of cheap labor and land. Vietnam's government is also competing in the global tax incentives race, but well-researched analysts say it does not have enough well-educated workers and that its bureaucracy is often cumbersome and unpredictable.

The next step for Vietnam is not only to attract foreign direct investment, but also to integrate multinational companies into the economy. Disadvantages in the country's investment climate, including poor infrastructure, weak enforcement of intellectual property rights, cumbersome procedures, underdeveloped supplier networks and a lack of local skilled talent, must be addressed immediately.

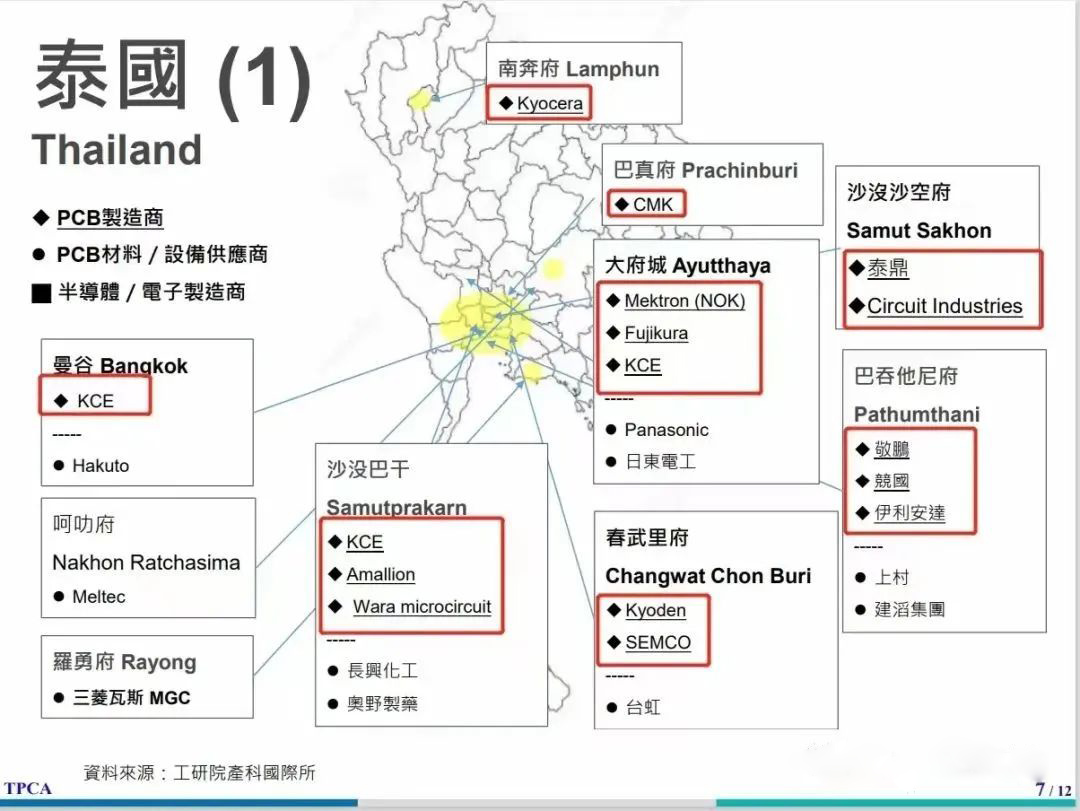

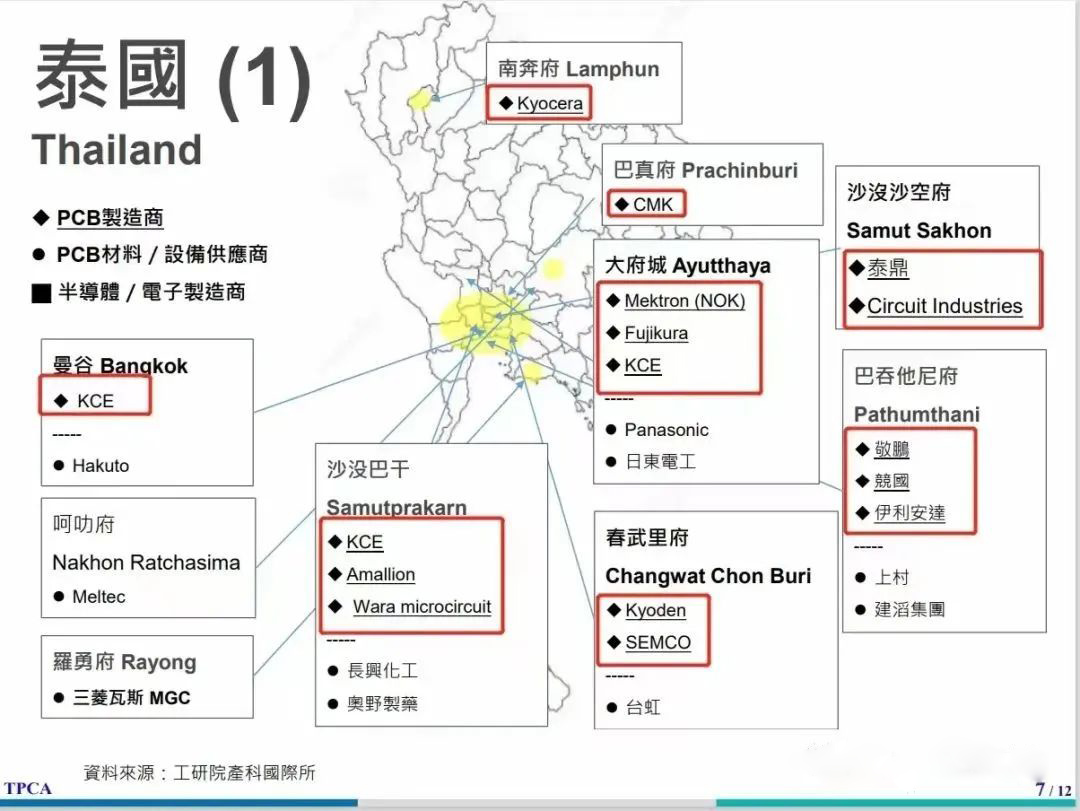

Thailand: Gathering place of Japanese semiconductor manufacturers

Thailand is the world's 13th largest manufacturing base for electronic products and components, and is also a gathering place for long-term investment by Japanese companies. SONY, ROM, Samsung, Murata, Toshiba, Kyocera and others have established Fab in Thailand. In addition, NXP, Western Digital and Microchip Technology also have factories in Thailand.

In terms of policy, Thailand approved tax incentives for semiconductor investment, giving 10-year tax breaks to front-end capital - and technology-intensive manufacturing industries such as wafer manufacturing. Projects that invest more than 1.5 billion baht in machinery such as advanced integrated circuits, IC substrates and printed circuit boards are exempt from corporate income tax for 8 years.

The Thai Board of Investment (BOI) said that companies that spend no less than 1% of their total sales on R&D in the first three years, or no less than 200 million baht, will receive an additional corporate income tax exemption for up to five years, with the number of additional years depending on the amount of research and development investment. For companies that increase investment in research and development in their main business, the maximum joint tax holiday is 13 years.

Thailand has a large pool of human resources, labor costs are a key factor in its competitiveness, currently about more than 750,000 people working in the electrical and electronics industry in Thailand, the government is actively stepping up efforts to improve the skills of the workforce to support the rapidly changing technology.

Philippines: MLCC capital

It is understood that the largest export category of the Philippines is the semiconductor industry, with exports of $40 billion in 2020, accounting for 62% of exports.

Among them, Manila, the capital of the Philippines, has the title of "MLCC factory gathering place", where Murata, Samsung, solar power and other MLCC manufacturers. Murata's large Manila plant accounts for 15% of the company's production capacity, according to data. Samsung's Manila plant accounts for 40% of the company's production capacity; Suntrap also has an MLCC production facility in Manila.

In contrast, the semiconductor industry layout of the Philippines is not complete, mainly the production of electronic components, especially MLCC. However, in recent years, the semiconductor industry has been diversified under the layout of more related enterprises.

To maintain its competitive edge, the Philippine government is working to attract more investment in the semiconductor industry and has also signed the Business Recovery and Business Tax Incentives (CREATE) Act, including a strategic investment priority plan for the electronics and semiconductor industries. It also provides incentives for job creation and value chains, national development, research and development, and the creation of new property and intellectual property.

Overall, while many countries have become semiconductor "stars", the industry in Southeast Asia is developing rapidly. According to a report by Fortune Business Insight, the ASEAN semiconductor market is expected to grow from $26.91 billion in 2020 to $41.88 billion in 2028, with a compound annual growth rate of 6.1%. In addition, Southeast Asia has also become one of the most important semiconductor exports.

India: Power chip manufacturing

In addition to these Southeast Asian countries, India has also revealed its "chip ambitions" from time to time, saying that semiconductor manufacturers face "geopolitical concerns" and "natural disaster risk" in Asia, and India will become an "alternative destination."

India has a great advantage in the field of designing chips, and Bangalore, India, is one of the world's largest chip design centers.

But it also left many people asking: "Does India have a semiconductor manufacturing industry?" Because compared with other Southeast Asian countries, the performance of Indian semiconductors is not outstanding. India imported $10.4 billion of hardware and software in 2020, while technology exports were only $300 million. Over the past two years, the pandemic has disrupted semiconductor supplies around the world, with India's chip shortage particularly acute.

The Indian government has realised that total reliance on global supply chains in key areas such as semiconductor chips is not reliable. Limited financial support and insufficient manufacturing capacity will seriously restrict the development of the semiconductor industry in the country

In 2022, the Indian government announced plans to invest Rs 760 crore to create a production incentive scheme that will provide "globally competitive" incentives for the semiconductor, display manufacturing and design industries, ushering in a "new era" of Indian electronics manufacturing.

At present, some companies choose to invest in India, the United States semiconductor equipment manufacturer Applied Materials invested 50 million US dollars in Bangalore to set up research and development facilities; Micron's rapid rise in India has also seen the establishment of an Indian research centre in Hyderabad; Singapore's IGSS Ventures will invest $3.25 billion to set up a semiconductor high-tech park in Tamil Nadu, India; Hon Hai and Indian mining and manufacturing group Vedanta have agreed a $19.4 billion deal to build a wafer fab in India, with operations expected to begin in 2024.

It has been revealed that TSMC is also seeking to set up a fab in India and is currently negotiating with different government ministries to confirm the feasibility of setting up a factory in India. TSMC has set up a large office in Bangaroor, India, to support customers in Asia, Europe and North America, and to support and encourage Indian fabless chip companies.

Another Taiwanese chipmaker, LPC, is also exploring discussions with a number of Indian companies to help set up new chip facilities there. Huang Chongren, chairman of the company, has said that the Indian authorities are actively planning the construction of local fabs and have sought to negotiate with the company, hoping that the company will provide assistance in the field of plant affairs and talents.

At the same time, Renesas Electronics, AMD, Intel and other international chip giants are also looking to set up bases in India, is expected to make "Made in India" to promote the global scale.

Recently, US Secretary of Commerce Raimondo bluntly said in an interview that the United States is considering promoting cooperation with India in chip manufacturing. She said she is expected to visit India in March with a number of American ceos to discuss related issues.

According to the Electronics and Semiconductor Association of India, the Indian semiconductor market is worth $27.2 billion in 2021 and is expected to more than double to $64 billion by 2026. In addition to the recent news in India, Samsung Semiconductor India Research Institute (SSIR) has announced a new partnership with the Indian Institute of Science (IISc).